Financing for any of your business needs

Funding in just a few clicks

Skip the lines and long waits at the bank. With business financing powered by Stripe, you can access funds you are pre-qualified for as soon as the next business day – all from your fingertips.

Simple, fast, and transparent

Housecall Pro makes it simple and fast for you to get the financing your business needs. You will be notified when you are pre-qualified (eligibility for financing is determined by factors like the volume and history of payments within HCP). Funds will arrive as soon as the next business day.

-

Apply in minutes online – no paperwork or long forms needed

-

If approved, receive your funds quickly, typically in 1-2 business days

-

Repay with no ongoing interest – just one flat fee

Automatic and flexible repayment

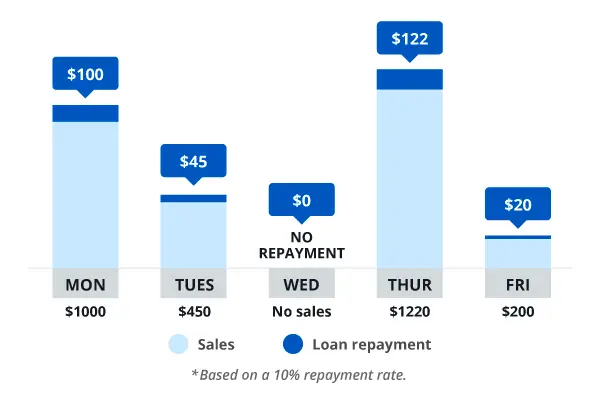

Repayment fits flexibly into your day-to-day operations, so you have one less thing to manage.

-

Automatically repay your loan through a portion of your daily sales – pay more when sales are higher and less when sales are lower

-

View your repayment history and check your paydown progress all within the Housecall Pro dashboard

-

Business financing seamlessly integrates with QuickBooks Online, so loan disbursements and repayment are automatically recorded for you

Available for any of your business needs

We’re here to support you – no matter what your goals are. Below are just a few examples of what business financing can be used for:

-

Purchase new equipment or a new vehicle

-

Hire a new team member

-

Create advertisements

-

Keep extra cash on hand

What pros have to say about business financing

You answer a few questions, and money is in the account!

You answer a few questions, and money is in the account! I don’t even notice repayment, which makes this loan very appealing. I will use funds for equipment and bringing marketing capabilities in-house.

David B.

Owner, The Trash Buster

San Rafael, CA

Business Financing FAQs

- How does Stripe Capital determine who qualifies for an offer?

-

Loan eligibility is based on a variety of factors related to your business, including volume of payments within Housecall Pro and your account history.

- What can Housecall Pro business financing be used for?

-

Financing can be used for any of your business needs – cover cash flow gaps, purchase supplies for that upcoming job, invest in new equipment, hire another staff member, and more.

- How does repayment work?

-

Repayment is collected automatically through a percentage of the credit card and ACH payments you receive through Housecall Pro, which means you pay down more when business is busy and less if things slow down.

- How much does Housecall Pro business financing cost?

-

The total amount you owe is your loan amount plus a flat fee. You won’t pay any interest or any other fees such as late fees, early payment fees, or origination fees.

- How is this different from consumer financing?

-

Consumer financing is for your customers, so you can win bigger jobs (when your customers borrow money, they may be able to afford jobs they couldn’t otherwise). Business financing is money for your business.

Loans are issued by Celtic Bank, a Utah-Chartered Industrial Bank Member FDIC. All loans subject to credit approval.

- Drive Sales

- Review Management Software

- Pipeline

- Recurring Home Service Agreement

- Online booking

- Sales proposal tool

- Receive and manage money

- Invoicing software

- Payment

- Expense Cards

- Business Financing

- Consumer Financing

- Know your business

- Enhanced Reporting

- Quickbooks

- Time Tracking

- Job costing and profitability

- Customer management

- business solutions

- Voice solution

- Conquer coaching

- Open API integrations

- Pro Community

- Call answering service

- explore more solutions

- Franchises

- See all solutions